Contents:

The importance of working capital managements in these current assets should not be inadequate or excessive than required since it can impact negatively on the capacity of production and also lead to the solvency of this company. Gross working capital helps in maintaining this that is why it is crucial. Often the interrelationships among the working capital components create real challenges for the financial managers. Inventory is purchased from suppliers, sale of which generates accounts receivable and collected in cash from customers to pay off those suppliers.

It is a company’s surplus of current assets over current liabilities, which measures the extent to which it can finance any increase in turnover from other fund sources. Funds thus, invested in current assets keep revolving and are constantly converted into cash and this cash flow is again used in exchange for other current assets. That is why working capital is also known as revolving or circulating capital or short-term capital.

- If the company owes more than they own, they will have negative working capital, and their business might get closed.

- Whether you are struggling to gain a competitive edge online or are working on bringing your business online, we are here to assist you.

- Your steps towards significance of working capital management will definitely improve your brand loyalty as well as profitability for your organization.

- Ans The three types of working capital management is conservative, aggressive, and moderate.

- Working capital is the lifeblood of any business, providing the necessary funds to keep operations running smoothly.

You get expert help, if you are ever stuck with the scalability of your business. On average, eight out of every eighteen industries showed a growth in the available day-to-day capital. In case one’s temporary capital increases due to a special and abnormal event, it is referred to as special working capital. For example, in a country where a cricket world cup tournament is going to be hosted, many businesses might need special working capital due to the sudden rise in business.

Supply Chain Finance, also called Supplier Finance or “Reverse Factoring”, is an easy and simple way to get funds to meet the working capital requirements of a business. This method usually involves a third party or lender who finances the business on behalf of the end customer. There are a few long-term sources of working capital that companies can utilize.

Many firms have been seen in the past closing down for the want of short term finance. The profitability of any business to a larger extent is affected by this source of finance due to efficient management of current assets and current liabilities. Hence, learning about managing working capital has become more important and critical in the modern scenario. Working capital management ensures the best utilisation of a business’s current assets and liabilities for the company’s effective operation.

The Inventory in Working Capital refers to the value of raw materials, finished products and the Work in Progress. It is important to maintain sufficient inventory so that the production process does not get interrupted. But too much investment in inventory can lead to losses because of price fluctuations. The management regularly takes decisions to maintain a certain level of inventory.

The Importance Of A Responsible Working Capital Management

This article is the first in the series ‘Understanding the facets of working capital management’. The applicant must not be over 70 years at the time of maturity of the loan. A company has various sources of working capital such as Spontaneous Sources, Short-term Sources, and Long-term Sources. Working capital management means to utilize the working capital in the best possible way. For emergencies that require immediate access to funds, most individuals tend to liquidate their savings. Before finalizing a vehicle, you should do a thorough research of various car models, their features and mileage, and finally, the mode of finance.

You may be doing great online, but it’s always better to learn more about things better. Learning experiences provided by us are enjoyable and beneficial at the same time. On the basis of day-to-day performances, however, the capital was only observed to increase around the equivalent performance of 0.1 days. The online registration form has to be filled and the certification exam fee needs to be paid.

Efficient Use Of Fixed Assets

Working capital management needs great care owing to potential interactions among its components. For instance, if the credit period that is offered to customers is extended it can result in extra sales. However, in such cases, the company might have to rely on a bank overdraft as its cash position may fall owing to the extended wait for payment from customers. Sometimes the overdraft’s interest might surpass the profit gained from the additional sales, particularly if there is a rise in the cases of bad debts.

Prudential Regulation Authority Business Plan 2023/24 – Bank of England

Prudential Regulation Authority Business Plan 2023/24.

Posted: Tue, 02 May 2023 09:14:30 GMT [source]

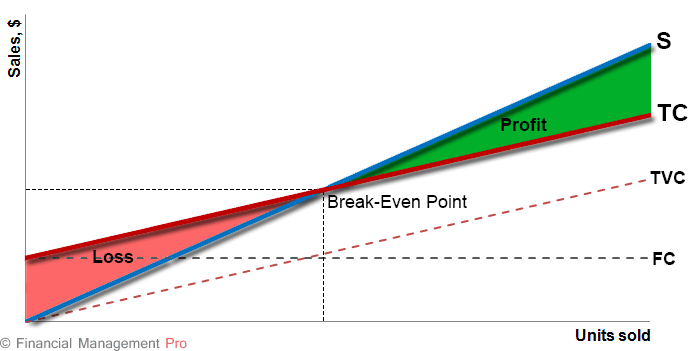

The lower any business’s liquidity the more likely any company would face financial distress while the different conditions are equal. Fixed working capital – investments required for starting and managing any business. Funds used as working capital are more likely to earn very little, or in fact, no, return.

Application Forms

We teach business owners and other aspirants the tricks to be focused on growth to drive their business forward. We conduct live sessions for businesses to understand the course content in depth. The pillars of our company conduct interactive sessions to give valuable insights.

Significance of Working capital management ensures that that the company has enough monetary liquidity to meet short-term debts. Structuring an effective working capital management is a great way to enhance the income. Ratio analysis and management of individual components of working capital are two primary importance of working capital management. It is not uncommon for an entity to halt operations due to mismanagement of working capital.

The management of these securities is linked to the Cash Management policies of the company. Financial planning in any company usually deals with the control of long-term and short-term financial resources. While the long-term resources are used to plan for expansion and growth, the short-term resources are mostly used to cover the operational expenses.

China’s Response to Türkiye’s Volatile Authoritarianism – Carnegie Endowment for International Peace

China’s Response to Türkiye’s Volatile Authoritarianism.

Posted: Fri, 05 May 2023 15:08:36 GMT [source]

Reinvestment the profits earned profit is a regular and cost less sources of funds. Gross working capital can be executed by calculating the difference between the existing assets and current liabilities. Current assets mean the money kept in a bank and assets that can be converted into cash in case if any situation arises. Current liabilities represent debt that an individual will pay within the prescribed year.

More details will be made available when the exam registration form is published. The author is Marketing head of The article written by him is in his personal capacity and educational in nature. You may write to author for your quarries at referring the article name and your details. It is partly due to weak credit worthiness of micro and small enterprises in the country. Due to their weak economic base, they find it difficult to take financial assistance from the commercial banks and financial institutions. Ship manager understood the specific challenges of our company, and created a financing solution which was just right.

The MSME sector, however, faces operational problems due to its size and nature of business, and is, therefore, relatively more susceptible to various shocks to the economy. Hero FinCorp business loan solution is a big factor in our business success. We enjoy working with a trusted financial partner which provides quick support and easy finance. Common challenges faced by enterprises in working capital managementWorking capital management is vital to ensure that the company has enough liquidity to fund its short-term expenses. CAs, experts and businesses can get GST ready with Clear GST software & certification course.

The two major components of Working Capital are Current Assets and Current Liabilities. One of the major aspects of an effective working capital management is to have regular analysis of the company’s currents assets and liabilities. This helps to take into account unforeseen events such as changes in the market conditions and competitor activities.

Higher working capital means a higher portion of assets financed by the owner’s equity. Higher equity implies that higher profits are needed to achieve the required return on capital employed. When the working capital can be efficiently managed and the owner’s equity finances only the required portion of assets, it results in a higher return on capital. The efficient utilization of cash is an important aspect of managing Working Capital.

Succeed Online With Highly Effective Business Tips and Tricks

A company starting with cash purchase raw-materials, components etc., on cash credit basis. These materials will be converted into finished goods after undergoing the stage of work-in-progress. For this purpose in the company has to make payments towards wages, salaries and other manufacturing costs.

A lack of adequate working capital means businesses won’t be able to pay salaries to staff or buy raw materials from suppliers. Working capital management is indispensable for the proficient and sustainable profitability of a firm. It can help you in managing your firm’s current assets and liabilities ineffably, and also allow you to run your operational activities smoothly. Having adequate working capital and efficient management of the same will help the business’s fixed assets to be utilised efficiently and effectively. Often, the business’s fixed assets remain idle due to the unavailability of components of working capital, such as raw materials, finished goods, and the shortage of funds to buy them.

In-house legal work: best practice case studies – Financial Times

In-house legal work: best practice case studies.

Posted: Fri, 05 May 2023 04:00:08 GMT [source]

On the other hand, if the entity has low operational expenses but fails to repay its dues on time, it negatively pacts the business’s credit score. The primary need of working capital management strategy in any business is to pay short-term liabilities on their due dates promptly. Another significant objective of a well-functioning working capital management system is generating profits. A high amount of working capital means an entity needs to earn higher profits to ensure the required return on capital employed. Therefore, it is critical to determine a healthy balance between profitability and liquidity while deciding the appropriate level of working capital management. In the context of working capital management, one needs to be cautious of overtrading and overcapitalising.

Gross Working Capital is the amount of funds invested in the various components of current assets. Negative working capital means the current assets are less than current liabilities, and it can even lead to bankruptcy if it is continued for several months or years. A sound working capital management provides the required data to the business owners and/or decision-makers. It helps them in understanding the underlying requirement of the business and its true financial status. Working capital ratios, budgets, and reports help them in identifying problem areas take corrective action. From a broader perspective, working capital is an indicator of a businesses’ short term financial health.

Working capital has to be managed because the firm cannot always control how quickly the customers will buy, and once they have made purchases, exactly when they will pay. Can aptly be called a short-term debt payable within short periods of time and is treated as a current liability by the entity that has to make the payment. It is the money owed by the businesses to its suppliers for the goods purchased or services consumed.

These refer to different approaches to managing the components of working capital. Due to the above reasons, we can conclude that an effective working capital management plan brings both strategic and financial advantages due to the reasons listed above. Some of the things one can keep in mind while framing an excellent working capital management plan are mentioned below. The standard method of Working Capital Management refers to the handling of the individual components of the Current Assets and Current Liabilities. This would mean that the company will usually have separate policies for management of Cash, Inventory, Receivables etc. More details of this type of management have been mentioned in the next section on this page.

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law. The efficient administration of working capital contributes to the regular payment of dividends to shareholders. In order for the organization to distribute dividends in a timely and orderly manner, it has to have adequate cash on hand.

The term current asset is used to describe anything that can be quickly changed into cash within a period of one year. These assets are predominantly found in the form of the most liquidated assets held by the business. Short-term investments, inventory contents, receivable accounts, and hard cash are some of the most common examples of current assets. On the contrary, net working capital is your current assets minus your current liabilities.