Contents:

Step 2 – Deposit funds into your account –Deposit funds into your account using the standard fiat methods – as eToro provides many options like Neteller. We review the best regulated cryptocurrency platforms to buy FTT, the native token of derivatives exchange FTX, including Binance. FTT is one of the altcoins that pulled a 10x gain in 2021. FTX is in the headlines yet again but this time it’s not positive. Rumors of insolvency caused a bank run, causing a massive crash in FTT’s price. This kind of volatility can be incredibly profitable but its ludicrously risky.

This is your gateway to securely and easily buy, exchange and grow your assets – all in one secure app. CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how an investment works and whether you can afford to take the high risk of losing your money. FTX’s Impressive Growth.As both supply of and demand for FTT are affected by how much people use FTX, the exchange’s popularity is an important factor for FTT value.

You can also multiply FTX Token via stablecoin without having to buy it to multiply it. Buying and holding FTX Token in your YouHodler wallet will allow you to access some of the best rates on the market, more stable on average than DeFi’s rates of return. Yes, you need to create an account with the partner of your choice.

Credit or debit card payment is one of the effortless ways to buy FTT and other cryptocurrencies in a fast and secure manner. With Changelly, you can use a Visa or a Mastercard credit card issued in your local currency. Binance.US is the clear choice for those who prioritize cryptocurrency selection.

However, under some circumstances, some cryptocurrency earnings are considered income and fall into the income tax category. When exchanging digital assets, the following taxable events qualify for capital gains and income taxes. CFD trading has made its way into the cryptocurrency industry, and FTT is now available as a CFD product. If you’re having trouble understanding bitcoin trading and where to keep your crypto funds, you may use CFDs to profit from FTT. We recommend trading FTT CFDs on the Binance or coinbase platforms since these are regulated and allow you to choose from various analytical tools. However, the clawback issue, which basically is when an exchange takes money from investors to cover for another person’s bankruptcy – was something FTX did with FTT tokens.

Buy FTX Token on Binance using Bitcoin bought on another exchange

Moreover, the restrictions on retail derivatives trading limit the selection of services offered by FTX in the United States. Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers have access to a huge variety of trading pairs. FTX Token is no different from other top altcoins in its volatility.

Getcrypto.info and its affiliates make the information in this web site available as a service to its customers and other visitors, to be used for informational purposes only. The FTX Token price page is just one in Crypto.com Price Index that features price history, price ticker, market cap, and live charts for the top cryptocurrencies. Faster Payments is a speedy payment method that allows residents of the United Kingdom to send payments in their local currency without incurring any additional exchange charges. There are hundreds of platforms around the world that are waiting to give you access to thousands of cryptocurrencies.

Choose a platform

It isn’t as what is ivykoin to use as Coinbase’s main platform, but it does have a nice selection of advanced features. Overall, it’s great for fee-conscious investors who don’t mind a bit of a learning curve. The time it takes to buy FTX Token can vary depending on the payment method you choose. For example, bank transfers can take several days, while credit card purchases may be processed instantly. It’s important to check the processing time for your chosen payment method on the platform you’re using before you make a purchase. “Not your keys, not your coins” is a widely recognized rule in the crypto community.

The End of Faking It in Silicon Valley – The New York Times

The End of Faking It in Silicon Valley.

Posted: Sat, 15 Apr 2023 07:00:00 GMT [source]

On the next page you’ll be given the option to select your preferred currency. Once your account is secured, return to the dashboard and click ‘security’. Swyftx acknowledges the Traditional Owners of the land on which our company is located, the Turrbal and Jagera peoples.

Will the Price of FTT Go Up in 2023?

https://cryptolisting.org/ has been on top for a while, but, in recent years, an upstart competitor called FTX began to nip at its heels. FTX was founded by a young American with wild hair known as SBF . They’ve seen massive hacks and mind-boggling swindles and stunning success stories.

Huobi Token (HT) Bounces Back While Binance Coin (BNB) And Collateral Network (COLT) Surge – Crypto Mode

Huobi Token (HT) Bounces Back While Binance Coin (BNB) And Collateral Network (COLT) Surge.

Posted: Thu, 04 May 2023 10:10:29 GMT [source]

They each have their advantages, but one important benefit they both share is extremely low trading fees, making them affordable places to buy and sell cryptocurrency. There are different buying options, supported crypto, payment methods, and transaction fees depending on the buying provider selected in Ledger Live. Also, some providers are not available in some countries due to local regulations. By integrating several buying providers, Ledger aims at provides you with as much freedom as possible when it comes to crypto. There are numerous options available, ranging from bank transfers to credit cards to payment processors. Binance, on the other hand, is a cryptocurrency-only platform.

How do I buy FTX Token(FTT)?

This makes it much more difficult for anyone to hack into your account. Before we break down FTX vs. Coinbase, it’s important to clarify that FTX has a separate platform for U.S. customers. FTX.US doesn’t have quite as many features as the main international platform.

A limit order, on the other hand, will let you specify a price at which to buy it in the future. You can purchase FTX Token directly with AscendEX’s 1-Click Convert function. Seamlessly convert any number of cryptocurrencies directly to FTX Token and pay 0% fees. AscendEX supports the deposit of more than 300 cryptocurrencies, several of which you can exchange for FTX Token at some of the best rates in the market. AscendEX is the best place to buy, sell, trade, and hold FTX Token easily. Signing up for a AscendEX account will allow you to buy, sell, and hold cryptocurrency.

All you have to do is go back to the exchange you purchased it on, find the trading pair with FTT and the asset you want to receive and make the trade. If you purchased FTT from Uniswap or another DEX just go to the Swap page, enter FTT and the token you want to swap for and complete the transaction. If you choose to use Uniswap to get your FTX tokens, you’ll need some Ethereum. You can purchase ETH on any major cryptocurrency exchange; some of the best are eToro, Gemini and WeBull. FTX Token is an ERC-20 token on Ethereum and the native crypto of the FTX Derivatives Exchange.

Due to regulations such as KYC , creating an account is necessarily. On Ledger Live, you can create accounts for the crypto you want to manage. You need to create one account of the crypto you want to buy.

FTX and Coinbase are two of the largest cryptocurrency exchanges in the world. They each have plenty of features and trading options, so experienced investors often narrow it down to these two exchanges. FTX.US and Binance.US have some of the lowest trading fees we’ve come across, even compared to other top crypto exchanges. Its trading fees range from 0% to 0.10%, and it offers zero-fee trading on some cryptocurrencies, including Bitcoin . FTX and Binance are two of the world’s leading cryptocurrency exchanges.

Binance acquired one of the more popular digital wallets, Trust Wallet, in 2018. FTX.US doesn’t have an official wallet, but you can transfer cryptocurrency from that exchange to any wallet you like. Cryptocurrencies are a high risk investment and cryptocurrency exchange rates have exhibited strong volatility. Exposure to potential loss could extend to your cryptocurrency investment. FTX has quickly risen to become one of the most popular crypto derivatives exchanges in the world, with some innovative features that help it stand out from the competition.

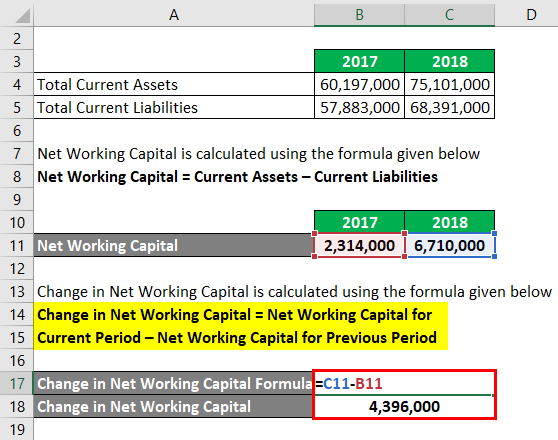

Calculating Your Capital Gains Tax

There are many different types of wallets available, so make sure to do your research before choosing one. Some people prefer to store their crypto offline in a “cold storage” wallet, which is considered to be the most secure option. Whichever option you choose, make sure to keep your private key safe and secure. The FTX token is the native cryptocurrency of the now-defunct FTX derivatives exchange.

If you choose the wrong direction (especially if you’re using margin) you could lose a lot of money really fast. Only trade with money you can lose trading volatile tokens like FTT because there is a high chance you will lose much of your investment. Bank account is usually the cheapest deposit method for buying coins. Limits are also usually higher when using a bank account, assuming you have verified your account.

The MyEtherWallet Ethereum wallet service

On this page, choose crypto coin you want to buy FTT, if it’s not available please buy USDT, and we will exchange it to FTT later. Once you’re done, you will need to go through some verification process, and finally, you’ll get your coins in the Binance wallet. The platform will require you to add a new card so that they can process the transactions. MyEtherWallet is a web service that offers the ability to create an Ethereum wallet . There will now be a new FTX Token wallet on the home screen. Click it and you’ll have the option to send and receive coins.

Bank and credit card withdrawals.Dual Asset Combines yield generating strategies from DeFi with traditional FinTech simplicity. Ledger hardware wallets are the smartest way to secure, manage and grow your crypto assets. If you’re looking for a simple way to buy FTX, all you need to do is sign up with a crypto exchange.

- On this page, choose crypto coin you want to buy FTT, if it’s not available please buy USDT, and we will exchange it to FTT later.

- Now that your account is secure and identity verified, on the top menu click ‘buy crypto’ and ‘credit/debit card’.

- It means that by utilizing eToro, investors can avoid not only commission-free trading but also monthly/annual fees.

- The platform will require you to add a new card so that they can process the transactions.

- Or, you can set a price at which you want to buy, and wait for the market to reach that point.

Bitfinex has relatively cheap trading costs, with most trades costing less than 0.20 percent. Pro traders may find it difficult to perform advanced technical analysis. EToro listed FTT along with other tokens to its list on May 31st 2022. You can buy FTX Token on Pionex (available for U.S. investors), Binance and Uniswap. For better coin compatibility, you consider buying a stablecoin like USDT or BUSD first, and then use that coin to buy FTX Token . Click on the “Buy Crypto” link on the top left of the Binance website navigation, which will show the available options in your country.

This ensures that your crypto trading experience is quick and reliable. Boasting a high liquidity order book for all listed cryptocurrencies, KuCoin delivers a liquid trading experience with tight spreads. That said, the price chart shows that FTT still has value as a tradable asset, which is why its value has seen some upticks. However, these upticks are choppy and have no real cause other than Bitcoin’s price movements. Furthermore, positive news about FTX is the only thing that’s positively contributing to FTX’s sudden ups in the price charts.

FTX employs a backstop liquidity program where large traders buy up liquidated trades before they can hurt the market as a whole. Most if not all leveraged exchanges like OKEx have insurance funds for large liquidations but can’t handle dramatic price movements like the FTX backstop program. Another intriguing feature of Capital.com is that, in comparison to other brokers, it provides services at a low cost.