When customers are upsold or cross-sold additional products and services, this increases revenue for the business. Your forecasted/estimated/expected ARR would be the recurring revenue actually generated or expected to be generated in each month of the year. Different LTV models can inform decisions like how much you can pay to acquire a new user, the effects of losing users, and how changes to a product affect the sum-total revenue you can expect to bring in from a user. Customer churn is a direct reflection of the value of the product and features you’re offering to customers—making churn rate a valuable metric to track. Calculating ACV helps inform your strategy and guide how much you should be investing in sales and marketing efforts. Subscription businesses can be successful with either a high or low ACV; however, it’s important to know where your business is aiming.

However, the formula does not take into consideration the cash flows of an investment or project, the overall timeline of return, and other costs, which help determine the true value of an investment or project. Both startups and established businesses use annual recurring revenue calculations to measure their progress and predict future performance. ARR also helps measure momentum for new contracts, upgrades/upsells, and renewals, but also metrics like churn or downgrades.

CAC

Below we explain the differences, how to calculate them, and some other metrics you should also be tracking. Our new set of developer-friendly subscription billing APIs with feature enhancements and functionality improvements focused on helping you accelerate your growth and streamline your operations. If your business is struggling, learning what ARR is and how to increase it can mean the difference between failing or succeeding. While ARR does approximate revenue, it is still a normalization value, so you’ll be hard-pressed to find an ARR data field or function in any GL or finance system.

- However, because NRR is measured in percentages (comparing Month 12 revenues to Month 1 revenues), NRR does not tell you about the size of a company.

- Failure to do so, may result in inaccurate data and poor financial decisions.

- To calculate Annual Recurring Revenue, simply divide the total contract value by the number of years.

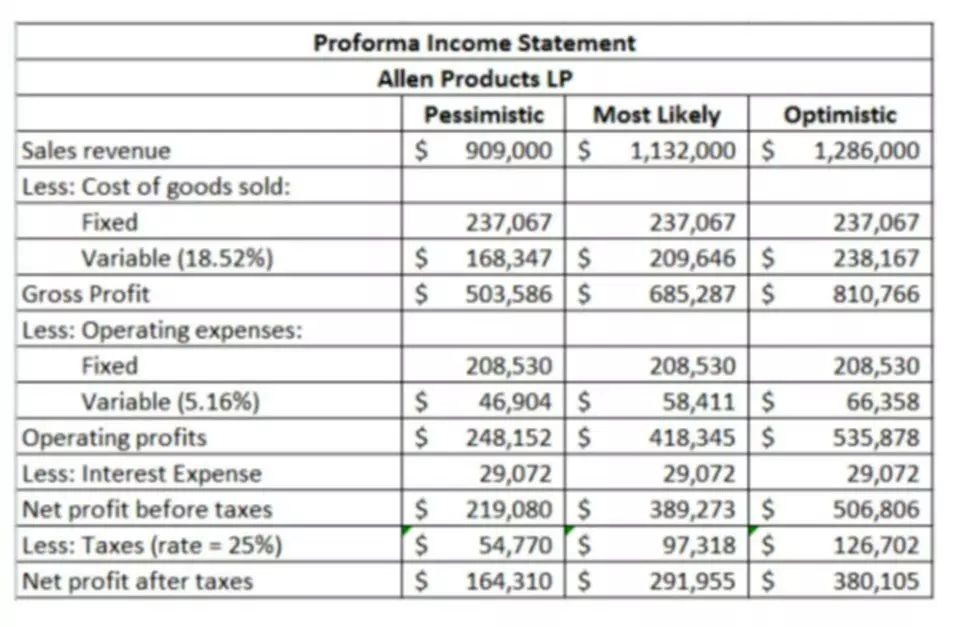

In addition, ARR doesn’t account for revenue recognition, meaning your picture of revenue growth is incomplete even when you know your ARR. Deeper insight into billing and collections efficiency is needed to obtain accurate revenue recognition. According to a recent study of 439 SaaS companies, the median ARR growth rate for companies ranged between 40% and 60%. However, average growth rates vary widely based on a business’s current growth stage. The calculation of ARR considers only recurring revenue and excludes any one-time or variable fees.

What Is the Accounting Rate of Return (ARR)?

The time value of money is the main concept of the discounted cash flow model, which better determines the value of an investment as it seeks to determine the present value of future cash flows. The ARR is the annual percentage return from an investment based on its initial outlay of cash. Another accounting tool, the required rate of return (RRR), also known as the hurdle rate, is the minimum arr stands for return an investor would accept for an investment or project that compensates them for a given level of risk. The metric is commonly referred to as a baseline, and it can be easily incorporated into more complex calculations to project the company’s future revenues. You use NRR when you want to see how well a company retains customers and upsells/cross-sells to the customers it retains.

This level of detail and segregation gives useful insights on a monthly basis. For businesses that offer yearly subscription contracts, tracking ARR makes more sense. This way, you can make informed decisions about how to best apply your efforts for growth.

Annual recurring revenue, or ARR, is a commonly-used SaaS term, and for good reason. There’s also ACV, which stands for “annual contract value.” With dozens of SaaS acronyms, ACV tends to get lost in the mix. Moreover, businesses that can adopt, or at least incorporate, annual subscriptions into their sales model may find that their revenue picture becomes easier to understand and more reliable to predict. Annualized Run Rate includes all recurring revenue, whether it occurs monthly or yearly.

How does SaaS Insights calculate ARR?

If your finance person is a bookkeeper (as is common in early-stage businesses), they will likely need education on both topics, as will managers in sales, marketing, and product functions. ARR is an invaluable metric for measuring the success of your SaaS business. In addition to calculating revenue for a one-year period, it also helps predict future growth and revenue based on the value of renewals and cost of churn, allowing you to manage expenses more easily.

ACV looks at one customer in particular and sees what the expected payout over a year is. For example, if a customer signs a multi-year contract, e.g. a five-year deal with you for $50,000, then your ACV for a single year would be $10,000. However, much of this revenue may not be predictable and, unless supported by extensive history and financial analysis, might be unreliable for financial decisioning. With that in mind, when calculating Annual Recurring Revenue, we would expect to find a lower dollar figure than that of overall company revenue. Within the Indie Hackers community, it is a common metric used when presenting success of a project. Without support for ARR and cancellations in your finance system, most turn to Excel to track and measure ARR and churn.

Accounting Rate of Return vs. Required Rate of Return

With ProfitWell Metrics, by Paddle, you can spend less time calculating and more time growing your business. Tracking MRR is crucial for financial forecasting and planning, AND measuring growth and momentum. You can make accurate financial projections in SaaS largely in part because MRR is consistent and predictable. Annual Recurring Revenue removes all revenue that is not contractually obligated from its equation, and calculates only annualized, guaranteed revenue from subscriptions and contracts.

Stay on the same page by ensuring everyone should have a clear understanding of the terminology, as well as the rules for the generation of the underlying numbers. Finally, according to the survey, businesses must achieve and sustain a growth rate above 100% to be in the top 25% of company growth worldwide. To get to this level, many later-stage companies utilize a top-down ARR model in their growth strategy. But when you look at the churn in a bigger picture with the ARR factored in, you know if it is reason enough to worry. Churn is the percentage of your customers who leave your service over a given period of time divided by the total remaining customers. Annual Recurring Revenue is calculated using gross revenue from contracts and subscriptions.

Having a solid understanding of your ARR highlights your momentum and compound growth. While the original definition of ARR only includes recurring revenue from yearly contracts or subscriptions, new definitions are slowly taking over in the business world. New or startup businesses are using Annualized Run Rate, which helps them get a better picture of their revenue streams rather than yearly contracts. Annual profit is a profitability-based metric, referring to the net income earned after deducting all expenses and costs from the total revenue generated over a year. It represents the financial gain or profit realized by the SaaS company during that period.

Understanding ARR

Both of them can be used for the same purpose which is to calculate the average rate of the room. However, ARR can also be used to measure the average rate for a longer period of time (weekly, monthly) while ADR may only be used to measure the average rate of one day. In this context, “ARR run rate” typically refers to the most recently completed month’s monthly recurring revenue, or MRR, multiplied by 12 (months). In this example, your business would have $12 million in ARR, or annual recurring revenue, for the prior fiscal or calendar year (depending on the timeframe one references or implies with their usage of the term). ARR, or annual recurring revenue, refers to a specific dollar (or other currency denomination) amount of your revenues that came as a result of some kind of subscription or recurring contractual obligation. ARR is the amount of revenue that a business expects to generate every year on a recurring basis.

For this coming year, we are on pace to hit $17.5 million in ARR for the full calendar year. Mistaking ARR for cash can create a falsified image of how much money a business has. That being said, it is never an either/or situation when it comes to ARR and MRR, as the former gives a long-term picture while the latter offers short-term insights. As I alluded to earlier, there aredozensof subscription acronyms and metrics. Calculating ACV and ARR results in different numbers, so when should you use each metric? To be frank, ACV isn’t a super-useful metric on its own, but pairing it with other SaaS metrics can provide some valuable insights.

When you check your monthly balances and see that you’re not making as much money as you thought, you can begin immediately to increase your bottom line instead of waiting for the next year to increase your revenue. In this template, you’ll find a comprehensive set of pre-built SaaS metrics (that you can trust) to wow investors and make key business decisions with confidence. The best-practice approach to create cancellation records is to record the cancellation in the same period as you would record it if it were a renewal. Doing so enables you to consistently measure renewals and churn, a mathematical must since churn is simply (1 – renewal rate). To calculate ARR churn, you also need to report on cancellations (essentially the absence of a renewal). However, measuring a cancellation using an “absence of data” is extremely difficult in Excel.

Since subscription commitments can indicate the relationship customers have with your product, their willingness to agree to an ongoing relationship may be an indicator of their confidence in your brand or satisfaction with your brand. Conversely, a high number of customers who prefer non-contractual interactions may indicate that they require an additional “nudge” to commit to your service financially. Annual Recurring Revenue considers all the subscription-based revenue for the entire year. While this might seem as simple as multiplying all monthly subscriptions by 12, that’s not exactly how it works.

Freshworks Expects a Full-year Operating Profit of USD 28 Mn, With … – Entrepreneur

Freshworks Expects a Full-year Operating Profit of USD 28 Mn, With ….

Posted: Wed, 02 Aug 2023 09:35:00 GMT [source]

Annual recurring revenue is often used in B2B subscription business when the minimum subscription term is one year. It also tends to be used by businesses with multi-year terms, and those with lower transaction volume and higher transaction value. While MRR is typically preferred by B2B businesses with monthly subscriptions (as well as B2C subscription businesses), it’s not uncommon for companies to use both metrics to represent their revenue.