If payments are not time-sensitive, CHIPS is a less expensive option than Fedwire, which processes gross settlements in real time. A settlement bank, also known as an “acquirer” or “acquiring bank,” works on the merchant’s end to assist with taking credit card payments from customers and receiving the funds in the merchant account. This financial institution does business with one or more card networks and serves as a middleman between the merchant and the card issuer’s bank when you use your card. Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient’s or sender’s bank account and their bank’s reserves. Because central banks run interbank settlement networks, settlement systems can facilitate money movement between banks, debiting the sender’s account and crediting the receiver’s account at the central bank directly.

Within minutes, banks can send and receive wire transfers through secure interbank payment networks, which clear and settle numerous daily transactions. Settlement banks are a primary component of the transaction process, helping to make electronic transaction processing available for merchants. With a significant majority of customers seeking to make electronic payments, it is important that merchants have good relationships with processing entities including settlement banks to ensure a fast and efficient payments system for their business and their clients. A settlement bank enables a merchant to allow you to pay with credit and debit cards and receive the funds in its merchant account. The settlement bank plays an important part in helping brick-and-mortar and online retailers do business and provide convenient payment options for you. This type of bank also can help with other services, such as handling customer chargebacks.

What are the tradeoffs in the two settlement arrangements?

The service is offered to depository institutions with Federal Reserve Bank master accounts that settle for participants in clearinghouses, financial exchanges and other clearing and settlement arrangements. Settlers benefit because the credits to their master accounts are final and irrevocable. These actions will trigger obligations among the participating financial institutions, and between them and their customers. As an example, when a payee’s financial institution accepts a payment order from the payer’s financial institution, the payer’s financial institution is obliged to pay the payee’s financial institution for the amount of the transaction. In turn, the payee’s financial institution is obliged to pay its payee customer.

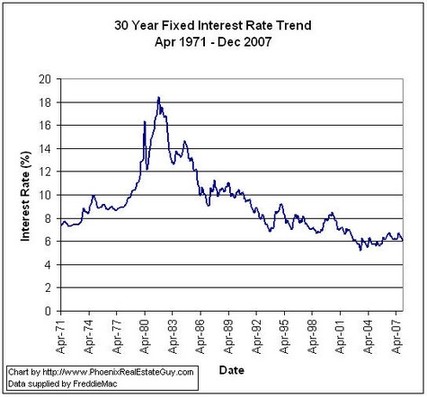

- Settlement of cash-settled interest rate swaps is in the form of periodic interest payments based on an interest rate over a term to maturity.

- In foreign exchange trades, settlement is typically facilitated by CLS Bank or via correspondent banks that allow counterparties to exchange currencies.

- Clearing involves modifying those contractual obligations so as to facilitate settlement, often by netting and novation.

- If a non-participant wishes to settle its interests, it must do so through a participant acting as a custodian.

- If payments are not time-sensitive, CHIPS is a less expensive option than Fedwire, which processes gross settlements in real time.

- As part of performance on the delivery obligations entailed by the trade, settlement involves the delivery of securities and the corresponding payment.

A settlement account is a transactional bank account functioning as quick access to accumulated cash. Banks can begin the settlement phase either immediately after clearing has taken place or later on. Most payment systems, CHIPS included, send a final settlement what is a settlement bank wire at the end of the business day to initiate this process. With information about the wire’s amount, recipient’s account number, and bank routing number, clearing networks pass the payment instructions from the sender’s bank to the recipient’s.

Any money resulting from a successful chargeback would appear in your bank account. In Bilateral Net Settlement, financial institutions settle with each other on a financial institution to financial institution basis. In Multilateral Net Settlement, the network operator provides each financial institution one sum to pay or receive based on all of its customer transactions with all of the other participating financial institutions.

National Settlement Service

Having access to the safest, smoothest and most efficient settlement systems is your priority when managing a wide range of transactions. With ensured speed and security in transactions, a business can benefit from time and cost-effectiveness by obtaining a settlement account to manage its financial activities. One commonly misunderstood system, the Society for Worldwide Interbank Financial Telecommunication (SWIFT), is neither a settlement network nor a clearing network. Instead, SWIFT is a messaging system which sends global payment orders to be processed by a clearing or settlement system.

Bilateral net settlement systems are payment systems in which payments are settled for each bilateral combination of banks. Banks that send out more funds in transfers than they receive (i.e., banks with a positive net settlement balance) are credited with the difference, and banks with a negative net settlement balance pay the difference. Though wire transfers facilitate the intraday transfer of funds, clearing and settlement do not occur with the same urgency. However, because the wire recipient can already access the delivered funds by the end of the clearing stage, the timing of settlement is more flexible. Banks can settle their accounts and exchange the wire amount either immediately after clearing or later on.

How the Service Works

Then the recipient’s bank deposits the wire amount into the recipient’s account using reserve funds. When the sending bank withdraws the corresponding amount from the sender’s account, clearing is completed. In a multilateral net settlement system, transfers received by a bank are offset against those sent out – here, “transfers” refer to the sum of all funds received and sent to banks that are part of the settlement system. NSS provides an automated mechanism for submitting settlement files to the Federal Reserve Banks and reduces settlement risk to participants by granting settlement finality on settlement day.

Settlement and clearing systems are an important component of modern payment operations. With one Euroclear Bank account, you get access to a wide range of markets, including the T2S platform. We operate robust links with local CSDs and other ICSDs, connecting domestic and international issuers, agents and investors, around the world. Settlement of cash-settled interest rate swaps is in the form of periodic interest payments based on an interest rate over a term to maturity.

- Every day, payments in different currencies pass through interbank clearing networks before settling in each currency’s interbank settlement network, typically run by their central bank.

- The settlement system does not stand in the chain of ownership, but merely serves as a conduit for communications of participants to issuers.

- A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank to settle any outstanding amounts.

- A settlement account is a transactional bank account functioning as quick access to accumulated cash.

- We offer various services to drive down the risk of settlement failure with, for example, an automated securities borrowing programme.

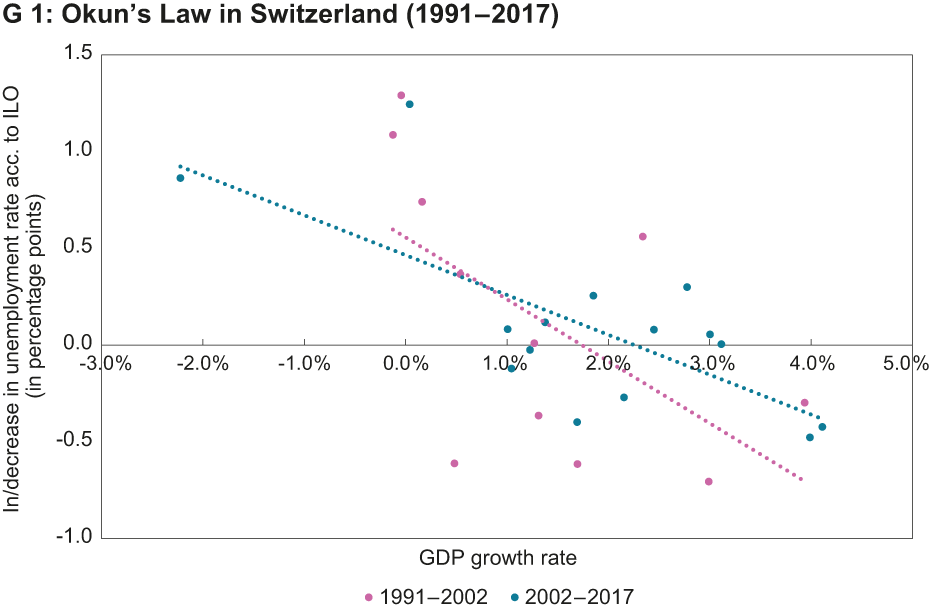

As between the two financial institutions and their respective customers, they will typically settle by debiting and crediting their respective customers’ accounts they maintain. But the financial institutions involved in the transaction will also need to settle among themselves. Network operators design their systems to create efficiencies and reduce risk for their participants, and network design will have implications for the risks involved in the settlement process. In particular, real-time gross settlement and deferred net settlement introduce tradeoffs in how they handle liquidity risk and credit risk. Settlement risk – the risk that one counterparty will fail in its obligations to the other – can be mitigated by the post-transaction process of clearing, as well as by real-time gross settlement (RTGS) systems. These transfer money or securities from one bank to another in real time rather than at the end of the day but do not provide the benefit of netting transactions.

For Businesses

Settlement involves the delivery of securities or cash from one party to another following a trade. After the trade and before settlement, the rights of the purchaser are contractual and therefore personal. Because they are merely personal, the purchaser’s rights are at risk in the event of the insolvency of the vendor. After settlement, the purchaser owns securities and his rights are proprietary. It involves upgrading personal rights into property rights and thus protects market participants from the risk of the default of their counterparties.

Midigator is a technology company dedicated to removing the complexity of payment disputes. We believe the challenge of running a business should be delivering great products or services, not managing payment risk. T+1 and T+2 are abbreviations that refer to the timing of settlement, expressed in days after the transaction date (T). The Depository Trust Company in New York is the largest immobilizer of securities in the world. Euroclear and Clearstream Banking, Luxembourg are two important examples of international immobilisation systems. Both originally settled eurobonds, but now a wide range of international securities are settled through them including many types of sovereign debt and equity securities.

If available funds are deducted and sent through the processing network to the settlement bank which settles the transaction for the merchant. 6 Some countries use real-time net settlement, where transactions net every few seconds, essentially in real time. However, these two systems are uncommon, particularly in the United States, so this article doesn’t address them. In a net settlement system, banks keep track of their electronic (and physical) credit and debit transactions throughout the day.

Decoding cross-border payments: From initiation to settlement – Trade Finance Global

Decoding cross-border payments: From initiation to settlement.

Posted: Fri, 04 Aug 2023 11:17:34 GMT [source]

To facilitate electronic transactions, the merchant must first open a merchant account and sign an agreement with an acquiring bank detailing terms for processing and settlement of transactions for the merchant. Acquiring settlement banks usually charge merchants a per transaction fee and a monthly fee for their services. Real-time settlement is when settlement between participants in the payment system occurs more or less concurrently with clearing the payment message(s).

What is settlement?

After a merchant partners with a settlement bank, it can accept card payments through compatible card networks. A settlement bank might choose to work with just a few major networks, such as Visa or Mastercard, or it might support others—such as Discover and American Express–to offer more flexibility for merchants and customers. Deferred net settlement systems are able to mitigate credit risk in a variety of ways. A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank to settle any outstanding amounts. Once the acquiring settlement bank accepts a cardholder’s payment card, the settlement bank then contacts its network to process the transaction. The payment brand network contacts the cardholder’s bank, also known as the issuing bank to ensure that funds are available.

Multilateral net settlement is more typical and is the implied netting approach in this article. Suppose banks A and B are part of a deferred net settlement system, with a grace deferral period of two months. At the end of the day (i.e., the exchange period), the clearinghouse processes the transactions and confirms that Bank A’s net settlement amount is –$600,000, and Bank B’s net settlement amount is $600,000. The Federal Reserve Banks provide the National Settlement Service (NSS), which allows participants in private-sector clearing arrangements to exchange and settle transactions on a multilateral basis through designated master accounts held at the Federal Reserve Banks. There are approximately 12 NSS arrangements that have been established by financial market utilities, check clearinghouse associations, and automated clearinghouse networks.

However, there are important differences in the way these systems transfer funds among participating financial institutions. Let’s start with liquidity risk, or the risk that a financial institution can’t settle at the designated time because it has insufficient funds available to it and can’t readily obtain funding from other sources. A deferred net settlement structure helps to optimize liquidity (and reduce liquidity risk), as each financial institution’s total settlement obligation is reduced by the amount owed to it by the other participants in the network. In the context of securities, settlement involves their delivery to the beneficiary, usually against (in simultaneous exchange for) payment of money, to fulfill contractual obligations, such as those arising under securities trades. In the United States, the settlement date for marketable stocks is usually 2 business days or T+2[3] after the trade is executed, and for listed options and government securities it is usually 1 day after the execution.

Clearing starts with financial institutions sending payment messages through the payment network; the payment network routes these messages and other related information for the participating financial institutions to correctly process payment instructions. In faster payment systems, these messages flow on a transaction-by-transaction basis, and by agreement among the participants, the clearing process enables faster payments to be credited to payees’ accounts in near real time. When an individual or business initiates a wire transfer, clearing begins the fund delivery process. First, the sender’s bank submits payment instructions to an interbank clearing network. These include each currency’s interbank settlement network along with systems dedicated to clearing. The Clearing House Interbank Payments Systems, known as CHIPS, is privately operated by The Clearing House (TCH).